"How Quitting Smoking Can Accelerate Your Journey to Financial Independence and Early Retirement (FIRE)"

Introduction

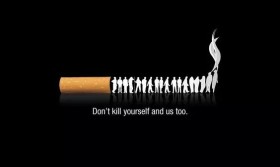

The Financial Independence, Retire Early (FIRE) movement has gained immense popularity as more people seek freedom from traditional 9-to-5 jobs. Achieving FIRE requires disciplined saving, smart investing, and cutting unnecessary expenses. One often-overlooked factor in this journey is quitting smoking.

Smoking is not just a health hazard—it’s a financial drain. By eliminating this costly habit, individuals can save thousands annually, reinvest those funds, and accelerate their path to financial freedom. This article explores how quitting smoking contributes to FIRE, the financial and health benefits, and practical steps to make it happen.

The Financial Cost of Smoking

1. Direct Costs: Cigarettes Add Up Fast

The average pack of cigarettes costs $6–$15, depending on location. A pack-a-day smoker spends:

- $2,190–$5,475 per year

- $21,900–$54,750 over 10 years

In high-tax states like New York, prices can exceed $13 per pack, leading to $4,745+ annually.

2. Indirect Costs: Healthcare and Insurance

Smokers face:

- Higher health insurance premiums (up to 50% more)

- Increased medical bills (respiratory diseases, cancer treatments)

- Lost productivity (more sick days, reduced work efficiency)

3. Opportunity Cost: Lost Investment Growth

If a smoker invests $5,000/year (saved from quitting) in an index fund with a 7% annual return, they could accumulate:

- $70,000+ in 10 years

- $250,000+ in 20 years

This compounding effect significantly boosts FIRE progress.

Health Benefits = Financial Benefits

1. Reduced Medical Expenses

Smoking-related illnesses (COPD, heart disease, cancer) lead to sky-high medical bills. Quitting lowers:

- Doctor visits

- Prescription costs

- Emergency treatments

2. Increased Longevity and Earning Potential

Non-smokers live 10+ years longer on average, allowing more time to:

- Grow investments

- Enjoy retirement

- Pursue side hustles or passion projects

3. Better Career Opportunities

Many employers penalize smokers through:

- Higher insurance deductibles

- Lower hiring preference (due to perceived health risks)

Quitting can improve job prospects and earning potential.

How to Quit Smoking and Redirect Savings Toward FIRE

1. Calculate Your Smoking Costs

Use a smoking cost calculator to see how much you spend annually. This motivates action.

2. Choose a Quitting Strategy

- Cold turkey (immediate cessation)

- Nicotine replacement therapy (patches, gum)

- Prescription medications (consult a doctor)

- Behavioral therapy (support groups, apps)

3. Automate Savings from Quitting

Set up an automatic transfer from your "former smoking budget" into:

- A high-yield savings account

- Index funds (S&P 500, VTSAX)

- Real estate investments

4. Track Progress

Use FIRE tracking tools (Personal Capital, Mint) to monitor:

- Savings growth

- Investment returns

- Net worth increase

Success Stories: Real People Who Achieved FIRE by Quitting Smoking

Case Study 1: John’s Early Retirement

- Smoking habit: 1 pack/day ($8/pack) → $2,920/year

- Quit at age 30, invested savings in ETFs

- Retired at 45 with $1.2M portfolio

Case Study 2: Sarah’s Side Hustle Boost

- Saved $200/month from quitting

- Used funds to start a blog + affiliate marketing

- Now earns $3,000/month passively

Conclusion: Quit Smoking, Accelerate FIRE

Quitting smoking is a double win—better health and faster financial freedom. By redirecting cigarette expenses into investments, individuals can shorten their FIRE timeline by years.

Key Takeaways:

✔ Smoking wastes $1,000s annually—eliminate this expense.

✔ Invest the savings for compound growth.

✔ Improved health = lower medical costs + longer earning years.

✔ Track progress to stay motivated.

Ready to quit and boost your FIRE journey? Start today—your future self will thank you.

Tags: #FIRE #FinancialIndependence #EarlyRetirement #QuitSmoking #PersonalFinance #Investing #WealthBuilding #HealthAndFinance #FIREMovement #MoneySavingTips