Smoking Aggravates Family Financial Burden: An Overlooked Crisis

Introduction

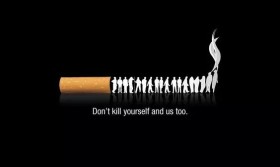

Smoking is widely recognized as a critical public health issue, linked to numerous diseases and premature death. However, its impact extends far beyond individual health, permeating the economic stability of families. The financial strain caused by smoking is a multifaceted crisis that often remains hidden behind cultural habits, addiction, and social norms. This article delves into the ways smoking aggravates family financial burdens, exploring direct costs, indirect economic repercussions, and the cyclical nature of poverty it can perpetuate.

The Direct Costs: A Drain on Household Income

The most apparent financial impact of smoking is the direct cost of purchasing cigarettes. For a pack-a-day smoker, the expense can be staggering. Depending on the region, a single pack may cost between $6 to $15 or more. Annually, this translates to approximately $2,200 to $5,500 per smoker. For a family with multiple smokers, this figure can double or triple, consuming a significant portion of the household income.

In low and middle-income families, this expenditure is particularly devastating. Money spent on cigarettes is diverted from essential needs such as nutritious food, education, healthcare, and housing. For instance, the annual cost of smoking for a single individual could cover a year's worth of groceries for a child or several months of utility bills. This misallocation of resources forces families to make difficult choices, often sacrificing long-term well-being for short-term addictive gratification.

Healthcare Expenditures: The Hidden Financial Time Bomb

While the cost of cigarettes is visible, the healthcare expenses associated with smoking are often delayed and thus overlooked. Smoking-related illnesses such as lung cancer, chronic obstructive pulmonary disease (COPD), heart disease, and stroke require extensive medical treatment. These treatments come with exorbitant costs, including doctor visits, hospitalizations, surgeries, and long-term medication.

Even with insurance, out-of-pocket expenses can be crippling. Co-pays, deductibles, and non-covered treatments can accumulate into tens of thousands of dollars. For uninsured families, the financial burden can lead to medical debt, bankruptcy, and the liquidation of assets such as homes or savings. The emotional toll of illness combined with financial stress creates a vicious cycle that can tear families apart.

Loss of Income: Reduced Earning Capacity and Productivity

Smoking adversely affects an individual's earning capacity. Smokers often experience more sick days due to smoking-related illnesses than non-smokers. This absenteeism reduces productivity and can lead to job loss or hindered career advancement. In many cases, chronic health conditions force smokers into early retirement or disability, drastically cutting their income during what should be their peak earning years.

Furthermore, the addiction itself can impair performance. Nicotine withdrawal can cause irritability and lack of concentration, affecting work quality. For families relying on the smoker's income, any reduction in earnings exacerbates financial instability, making it harder to meet daily expenses and plan for the future.

Impact on Family Dynamics and Future Generations

The financial strain of smoking often leads to conflict within families. Spouses and children may resent the smoker for prioritizing cigarettes over family needs. This resentment can erode trust and communication, leading to marital discord and even divorce—a process that itself carries significant financial and emotional costs.

Children in smoking households face disproportionate disadvantages. Money spent on tobacco is unavailable for educational resources, extracurricular activities, or college savings. This lack of investment in human capital perpetuates a cycle of poverty. Children from low-income families with smokers are less likely to break free from economic hardship, as they miss out on opportunities that could lead to better employment and financial security in adulthood.

Environmental and Secondary Costs

The financial burden extends to secondary costs that are seldom considered. Smoking causes damage to property, such as stains on walls and furniture, and increased wear and tear on homes and vehicles. These damages necessitate more frequent cleaning, repainting, or replacements, adding to household expenses.

Additionally, smokers often face higher insurance premiums. Life insurance, health insurance, and even home insurance can be more expensive for smokers due to the associated risks. These increased premiums further strain the family budget, diverting funds that could be used for wealth-building activities like investments or savings.

The Broader Societal Cost and Family Indirect Payment

While this article focuses on the family, it is important to note that smoking places a heavy burden on society through increased healthcare costs and lost productivity. These societal costs are ultimately borne by taxpayers and, by extension, families. Higher taxes to fund public health initiatives or social security for smoking-related disabilities mean that even non-smoking families indirectly pay for the consequences of tobacco use.

Breaking the Cycle: Cessation as a Financial Strategy

Quitting smoking is one of the most effective financial decisions a family can make. The immediate savings from not purchasing cigarettes can be redirected towards debt reduction, savings accounts, or investments. Moreover, improved health leads to lower medical bills and higher productivity, enhancing overall financial stability.

Families can support cessation through encouragement, seeking professional help, and utilizing nicotine replacement therapies. While these interventions have a cost, they are a fraction of the long-term expense of continued smoking. Viewing smoking cessation as a strategic financial move can provide powerful motivation for change.

Conclusion

The assertion that smoking aggravates family financial burden is irrefutable. From direct costs and healthcare expenses to lost income and intergenerational poverty, the economic impact of tobacco use is profound and pervasive. Addressing this issue requires a shift in perception—seeing smoking not just as a health hazard, but as a significant economic behavior that jeopardizes family security. By understanding the full scope of this financial drain, families and policymakers can prioritize cessation and prevention, paving the way for healthier and more economically stable futures.